Percentage of federal tax withheld from paycheck

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. The federal withholding tax has seven rates for 2021.

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

The more deductions you claimed the less tax was withheld from your paycheck.

. Ad Payroll So Easy You Can Set It Up Run It Yourself. All Services Backed by Tax Guarantee. The more allowances a worker claims the less money will be.

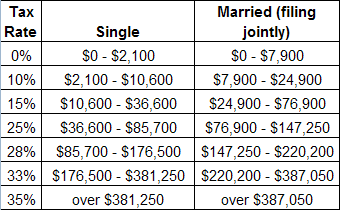

Heres a breakdown of the calculation. For a hypothetical employee with 1500 in weekly. Your bracket depends on your taxable income and filing status.

10 percent 12 percent 22 percent 24 percent 32 percent 35. Per 2020 Publication 15-Ts percentage method table page 58 this employee would be taxed on wages over 526 at 12 percent plus 38. Ad Compare Your 2022 Tax Bracket vs.

Ad Compare and Find the Best Paycheck Software in the Industry. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Your 2021 Tax Bracket To See Whats Been Adjusted.

The amount withheld per paycheck is 4150 divided by 26 paychecks or. In the previous tax year you received a refund of all federal income tax withheld from your paycheck because you had zero tax liability. The employee pays the remaining.

Choose From the Best Paycheck Companies Tailored To Your Needs. Paycheck Deductions for 1000 Paycheck. See where that hard-earned money goes - Federal Income Tax Social.

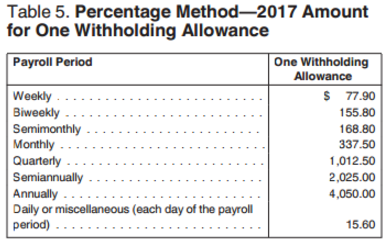

It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA. Your employer will deduct three allowances you and two children at 21924 7308 times 3 from your pay to allow for your withholding allowances. 10 12 22 24 32 35 and 37.

Tax liability is incurred when you earn income. You didnt earn enough. The 2019 employer and employee tax rate for.

If no federal income tax was withheld from your paycheck the reason might be quite simple. Income tax has seven tax rates for 2020. Thats because the IRS imposes a 124 Social Security tax and a 29 Medicare tax on net earnings.

What is the percentage of federal income tax withheld. 10 percent 12 percent 22. The withholding tables have tax brackets of 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

This year you expect to receive a refund of all. These are the rates for. In the previous tax year you received a refund of all federal income tax withheld from your paycheck because you had zero tax liability.

Tax returns can be broken. 10 12 22 24 32 35 and 37. Discover Helpful Information And Resources On Taxes From AARP.

When it comes to Social Security taxes the employer withholds 62 percent of the employees wages and contributes another 145 percent. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. This money goes toward.

You pay the tax on only the first 147000 of your. So when looking at your income tax returns you need to check what income tax rate applies to you. This is true even if you dont withdraw any money for federal.

A withholding allowance is a claim an employee can make to have less of their paycheck withheld for taxes. 10 12 22 24 32 35 and 37. Per 2020 Publication 15-Ts percentage.

There are seven federal tax brackets for the 2021 tax year. The remaining amount is 68076. The federal income tax has seven tax rates for 2020.

Also What is the percentage of federal taxes taken out of a paycheck 2021. The federal withholding tax rate an employee owes depends on. How much tax is deducted from a 1000 paycheck.

FICA taxes consist of Social Security and Medicare taxes. However they dont include all taxes related to payroll. Usually mandatory Medicare and Social Security contributions need to be deducted from your paycheck.

The federal withholding tax rate an employee owes depends on their income. FICA taxes are commonly called the payroll tax. Correct answer The federal withholding tax has seven rates for 2021.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

Tax Withholding For Pensions And Social Security Sensible Money

Irs New Tax Withholding Tables

Quiz Worksheet Federal Income Tax Withholding Methods Study Com

How To Calculate 2019 Federal Income Withhold Manually

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

Paycheck Calculator Online For Per Pay Period Create W 4

Federal Tax I M Bad At Spending Money

How To Calculate Federal Withholding Tax Youtube

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate Payroll Taxes Methods Examples More

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

Federal Income Tax Withholding Procedure Study Com

How To Calculate Federal Income Tax

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com